What Are Dividends and How Are They Taxed?

If you own shares in UK companies or invest in dividend-paying stocks, understanding how dividend tax works is crucial for managing your finances effectively. Unlike salary income, dividends are taxed differently and come with their own set of rules, allowances, and rates that can significantly impact your take-home income.

This comprehensive guide will walk you through everything you need to know about dividend taxation in the UK, from basic concepts to practical calculation examples, helping you navigate this important aspect of investment income.

Dividends are payments made by companies to their shareholders from profits. When you own shares in a company, you’re entitled to receive a portion of the company’s profits in the form of dividend payments. These payments are typically made quarterly or annually, depending on the company’s dividend policy.

Unlike employment income, dividends are not subject to Pay As You Earn (PAYE) tax deduction at source. This means you receive the full dividend amount and are responsible for calculating and paying any tax due yourself. The tax treatment of dividends is designed to account for the fact that companies have already paid corporation tax on their profits before distributing dividends to shareholders.

UK Dividend Tax Rates, Bands, and Allowances for 2024/25

The UK Dividend Allowance

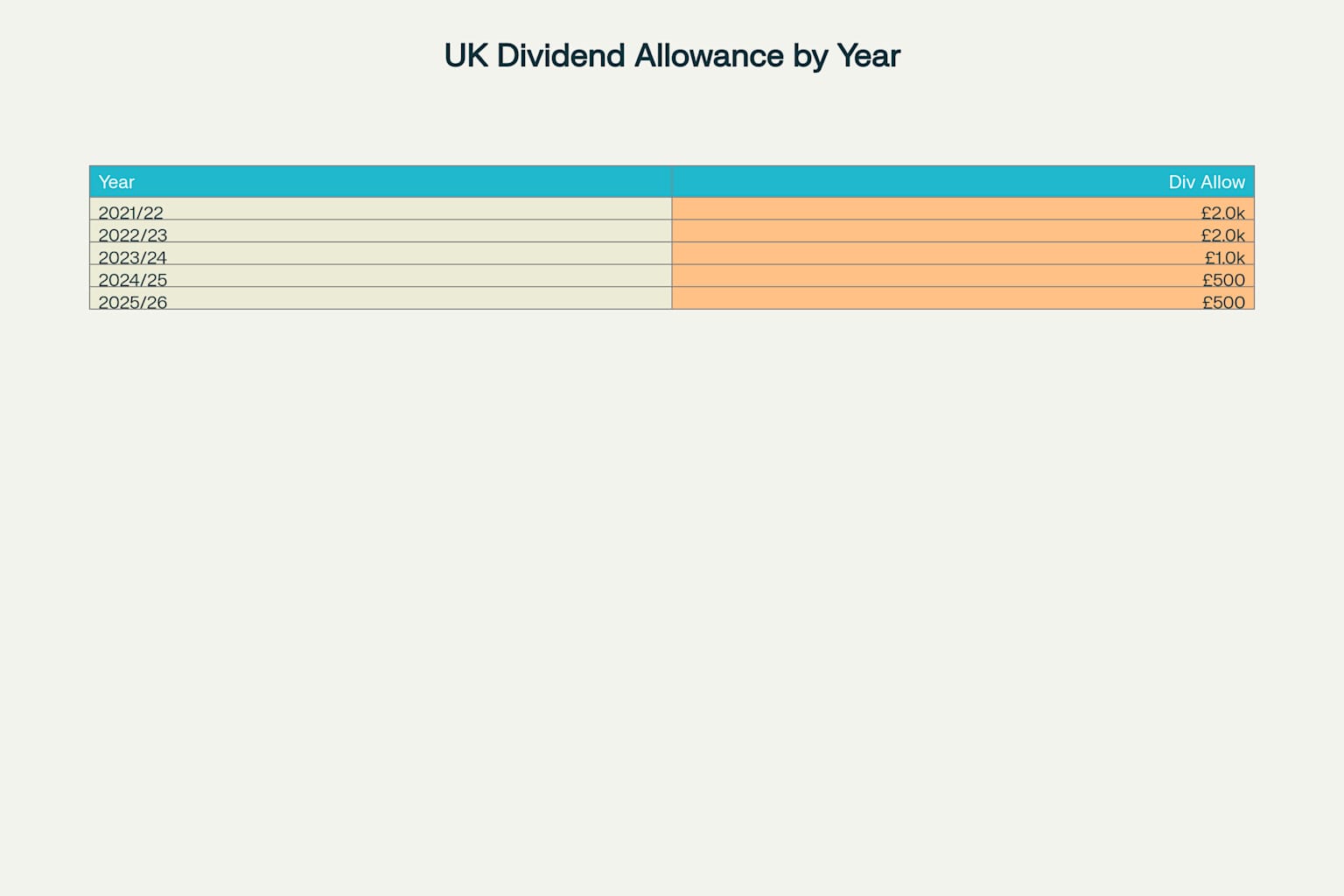

The dividend allowance is the amount of dividend income you can receive tax-free each year. For the 2024/25 and 2025/26 tax years, this allowance is set at just £500. This represents a significant reduction from previous years, when the allowance was much more generous. The dramatic reduction in the dividend allowance over recent years means that most investors with meaningful dividend income will now pay some tax on their dividends.

Dividend Tax Rates by Income Band

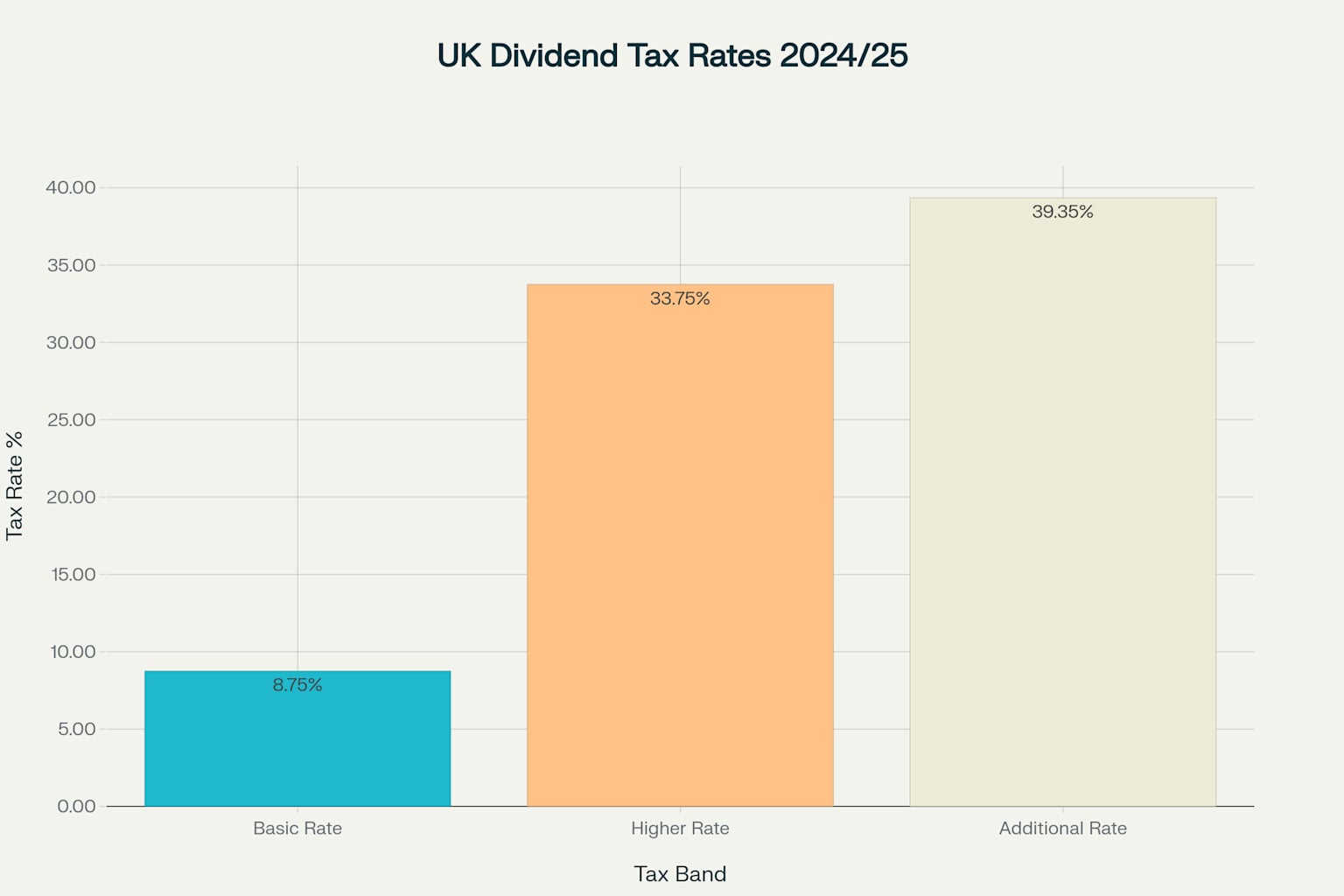

Once you exceed the £500 dividend allowance, the tax rate you pay depends on your total income tax band. The current rates for 2024/25 are:

- Basic Rate: 8.75%

- Higher Rate: 33.75%

- Additional Rate: 39.35%

These rates apply to dividend income above the £500 allowance, and you may pay tax at multiple rates if your dividend income spans different tax bands.

How Your Tax Band is Determined

Your tax band for dividend purposes is calculated by adding your total dividend income to your other income sources. This includes:

- Employment income (salary, wages, bonuses)

- Self-employment profits

- Rental income

- Interest from savings

- Any other taxable income

The combined total determines which tax band(s) apply to your dividends.

Income Tax Bands for 2024/25

| Tax Band | Income Range | Dividend Tax Rate |

|---|---|---|

| Personal Allowance | £0 – £12,570 | 0% |

| Basic Rate | £12,571 – £50,270 | 8.75% |

| Higher Rate | £50,271 – £125,140 | 33.75% |

| Additional Rate | Over £125,140 | 39.35% |

How to Calculate Your Dividend Tax: A Step-by-Step Guide

The Four Steps to Calculation

- Calculate Your Total Income: Add up all your income sources for the tax year.

- Apply Your Personal Allowance: Subtract your Personal Allowance (£12,570 for 2024/25) from your non-dividend income first, then any remainder against dividends.

- Apply Your Dividend Allowance: The first £500 of dividend income is tax-free.

- Calculate Tax on Remaining Dividends: Apply the appropriate tax rates based on your income bands to any dividend income above the allowances.

Practical Calculation Examples

Let’s look at some real-world scenarios to illustrate how dividend tax works in practice:

Example 1: Low Earner

- Salary: £20,000

- Dividends: £3,000

- Total Income: £23,000

Calculation:

- Personal allowance covers first £12,570 of total income

- Dividend allowance covers first £500 of dividends

- Remaining £2,500 of dividends taxed at 8.75% = £218.75

- Total dividend tax: £218.75

Example 2: Basic Rate Taxpayer

- Salary: £35,000

- Dividends: £15,000

- Total Income: £50,000

Calculation:

- All income falls within basic rate band

- Dividend allowance covers first £500

- Remaining £14,500 taxed at 8.75% = £1,268.75

- Total dividend tax: £1,268.75

Example 3: Higher Rate Taxpayer

- Salary: £60,000

- Dividends: £20,000

- Total Income: £80,000

Calculation:

- Salary uses up basic rate band

- All dividends (above allowance) taxed at higher rate

- £500 dividend allowance tax-free

- Remaining £19,500 taxed at 33.75% = £6,581.25

- Total dividend tax: £6,581.25

Example 4: Company Director Strategy

- Salary: £12,570 (personal allowance)

- Dividends: £50,000

- Total Income: £62,570

Calculation:

- £500 dividend allowance tax-free

- £37,700 taxed at 8.75% = £3,298.75

- £11,800 taxed at 33.75% = £3,982.50

- Total dividend tax: £7,281.25

Reporting and Paying Your Dividend Tax to HMRC

Who Needs to Report Dividend Income?

You must report dividend income to HMRC if your dividend income exceeds £10,000, OR if you already complete a Self-Assessment tax return for other reasons.

- For Dividend Income Up to £10,000 (if you don’t do Self Assessment): You can ask HMRC to adjust your tax code or contact them directly to arrange payment.

- For Dividend Income Over £10,000: You must register for Self Assessment and complete a tax return.

Important Deadlines:

- Registration deadline: 5 October following the tax year end

- Paper tax return deadline: 31 October

- Online tax return deadline: 31 January

- Payment deadline: 31 January following the tax year end

Dividend Vouchers and Record Keeping:

Since 2018, companies must issue dividend vouchers for all dividend payments. These vouchers serve as receipts and contain essential information including:

- Company name and registration number

- Shareholder name

- Dividend amount

- Payment date

Keep all dividend vouchers as you’ll need them for your tax return. From April 2025, directors will need to provide additional detail about dividends from their own companies, including the company registration number and shareholding percentage.

Strategies to Receive Dividends Tax-Free

Use a Stocks and Shares ISA

The most effective way to receive dividends tax-free is through a Stocks and Shares ISA. All dividend income received within an ISA is completely free from tax and does not use up your £500 dividend allowance. The annual ISA limit is £20,000 for 2024/25.

Invest Through a Pension

Dividends received on investments held within pension funds (like a SIPP) are also tax-free, allowing your investments to grow without being eroded by tax.

Consider Spousal Income Splitting

If you are married or in a civil partnership, you can transfer shares to the lower-earning spouse. This allows you to utilise their Personal Allowance, their £500 dividend allowance, and potentially benefit from a lower dividend tax rate.

Helpful Tools and Resources

Online Dividend Tax Calculators

- GoForma: Detailed breakdowns by band

- Finder: Tax impact on overall income

- 1st Formations: Salary + dividend strategy support

HMRC Guidance and Tools

- GOV.UK Dividend Tax Page

- Self Assessment Online

- HMRC Helpline

Professional Tax Software

- Tools like Tax Filer simplify reporting and FTSE dividend integration.

Common Mistakes and Future Planning

Common Pitfalls to Avoid

- Not Keeping Proper Records: Always retain dividend vouchers.

- Forgetting the Personal Allowance: This can be used against dividends.

- Missing Registration Deadlines: The 5 October deadline is crucial.

- Ignoring ISA Benefits: Not using your ISA is paying unnecessary tax.

Preparing for Future Changes

The dividend allowance remains at a low £500 for 2025/26, showing a clear trend towards increased taxation on investment income. Furthermore, from April 2025, directors will face enhanced reporting requirements for dividends from their own companies, indicating greater scrutiny from HMRC.

When to Seek Professional Help

Consider hiring an accountant or tax adviser if your dividend income is substantial, your investments are complex, or you want to ensure you are optimising your tax efficiency through legitimate planning.

Conclusion

Understanding dividend tax in the UK is essential for anyone receiving investment income. With the dividend allowance now at just £500 and tax rates ranging from 8.75% to 39.35%, proper planning can save you significant amounts of money.

The key points to remember are:

- Keep detailed records of all dividend income

- Understand how your total income affects your dividend tax rate

- Make full use of ISAs and other tax-efficient investment vehicles

- Meet all reporting deadlines to avoid penalties

- Consider professional advice for complex situations

By following the guidance in this article and staying informed about tax rule changes, you can effectively manage your dividend tax obligations while maximising your investment returns.